We are sure many will feel cheated, but it’s not the organization it’s your mistake to not analyze your salary slip properly.

It’s a psychology of every employee to look at what he gets on hand. First thing when you get your salary do not accept it, take it home and dissect it. Try to extract what will you get on hand rather than looking at the CTC.

Note: - We have written this tutorial according to Indian corporate industry. But the basic concept will hold true even for other geographical corporates.

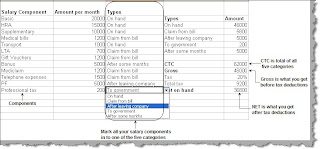

We will devise a simple methodology by which we can conclude our on-hand component easily. Every salary slip has lot of components like basic, HRA, PF etc. Every salary slip component falls in to five categories as shown in figure ‘Five categories’.

Figure: - Five categories

On hand: - Salary components which you get on hand needs to be pushed in to this category. Some of the examples are basic, HRA etc. This component is something which you get fixed and directly in to your hand.

Claim from bill: - There are some salary components which we get after submitting bills. Please note this is not a monthly on-hand component, rather it’s a claim which you get after submitting bills. Some of the examples of this category are LTA and phone bills.

After some months: - There are salary components like bonus or some organization call them as retention bonus which is received after some months. This can be in a form of yearly or quarterly bonus. Bonuses depend on company policies and many companies add this to your CTC. Again this amount is not received in the same month itself and they do not form the monthly on-hand component.

After leaving company: - There are some salary components which we get after leaving the company. For example provident fund (PF). Again this component does not add to your on-hand monthly, rather its something you will get after resignation.

To government: - Some of the salary components go to the government like PT (professional tax), IT (Income tax) etc. You will never get this amount. It’s something you pay to the government for the facilities they provide or you can say for running the country.

Now that we have segregated our components in to the above five categories, its time to understand three principles CTC, Gross and Net.

CTC is everything that company spends on us. Many professionals get carried by the CTC figure and hop the jobs. CTC is the addition of all the five components. Yes you guessed it right it also has the salary component which you will not get on hand.

CTC = on hand + Claim from bill + after leaving company + to government + after some months.

Gross is only on hand. This is the figure on which you should negotiate. Many times company try to shuffle the salary components in the above categories to come to this figure, be careful and alert when they do so.

Gross = on hand

Net is what get exactly on hand after Income tax deduction.

Net = Gross – Tax on gross.

We have provided a simple excel sheet ‘SalaryCalculation.xls’ which can help you extract the on-hand component from your salary slip. You just need to enter all components and select from the combo box in which category the components belong. This sheet is a sample sheet, so probably you will need to add and remove some components according to your slip. Also you need to adjust the tax value according to your salary range.

Below is a snapshot of the salary calculator EXCEL sheet.

On hand: - Salary components which you get on hand needs to be pushed in to this category. Some of the examples are basic, HRA etc. This component is something which you get fixed and directly in to your hand.

Claim from bill: - There are some salary components which we get after submitting bills. Please note this is not a monthly on-hand component, rather it’s a claim which you get after submitting bills. Some of the examples of this category are LTA and phone bills.

After some months: - There are salary components like bonus or some organization call them as retention bonus which is received after some months. This can be in a form of yearly or quarterly bonus. Bonuses depend on company policies and many companies add this to your CTC. Again this amount is not received in the same month itself and they do not form the monthly on-hand component.

After leaving company: - There are some salary components which we get after leaving the company. For example provident fund (PF). Again this component does not add to your on-hand monthly, rather its something you will get after resignation.

To government: - Some of the salary components go to the government like PT (professional tax), IT (Income tax) etc. You will never get this amount. It’s something you pay to the government for the facilities they provide or you can say for running the country.

Now that we have segregated our components in to the above five categories, its time to understand three principles CTC, Gross and Net.

CTC is everything that company spends on us. Many professionals get carried by the CTC figure and hop the jobs. CTC is the addition of all the five components. Yes you guessed it right it also has the salary component which you will not get on hand.

CTC = on hand + Claim from bill + after leaving company + to government + after some months.

Gross is only on hand. This is the figure on which you should negotiate. Many times company try to shuffle the salary components in the above categories to come to this figure, be careful and alert when they do so.

Gross = on hand

Net is what get exactly on hand after Income tax deduction.

Net = Gross – Tax on gross.

We have provided a simple excel sheet ‘SalaryCalculation.xls’ which can help you extract the on-hand component from your salary slip. You just need to enter all components and select from the combo box in which category the components belong. This sheet is a sample sheet, so probably you will need to add and remove some components according to your slip. Also you need to adjust the tax value according to your salary range.

Below is a snapshot of the salary calculator EXCEL sheet.

Figure: - Salary calculator

You can download the excel sheet from http://www.geocities.com/shiv_koirala/SalaryCalculation.xls

Looking for IT interview question bank visit http://www.questpond.com/

2 comments:

Cannot get to the Excel Sheet. Can you please repost it? The Geocities webpage is no longer actvie.

Same here..can U please repost it. Thanks in advance

Post a Comment